DISCIPLINED EXECUTION AND STRATEGIC FOCUS

As we close the chapter on 2025 and begin 2026, we’re excited to look back on what has been an incredible year of honing our discipline and inward focus and take a moment to appreciate everything this year has brought for our firm.

Even with a challenging market backdrop, we stayed intentional and committed to our investment approach — working collaboratively with our partners to support long-term growth and build enduring value. In 2025, we sought to bring disciplined decision-making and operational support where it matters most, navigating the year side-by-side with resilience and genuine partnership.

As we shift our focus to 2026, we’re incredibly grateful to our team, portfolio management teams, investors and partners. We couldn’t do it without you – thank you for everything you do!

2025 PORTFOLIO HIGHLIGHTS

In 2025, we invested in a new platform company and expanded our current portfolio. See below for highlights:

Kian Capital’s Team Air Accelerates Expansion, Wins Pinnacle Performance Award for Eighth Time

Team Air Distributing expanded its landmark presence across key Georgia and Tennessee markets, and received its eighth Pinnacle Performance Award provided by Trane Technologies.

Kian-Backed SPATCO Energy Solutions Continues National Expansion with Acquisition of Excell Fueling Systems

The acquisition added commercial services to SPATCO’s Texas portfolio and rounded out the platform’s comprehensive suite of services in the state.

Kian-Backed Diamond Landscaping Expands Geographic Footprint with Two Strategic Acquisitions

The acquisitions bring two high-end operators to the platform and expand operations into Arizona and Connecticut.

Kian Capital Makes Strategic Investment in Perimeter Holdings USA, a Leading Provider of Gate, Fence and Access Control Services

Kian partnered with two private investment firms, Bochi Investments and Skyline Global Partners, to combine the two leading regional operators, Salem Westchester LLC and Riverside Fence Company, to create Perimeter Holdings USA.

Kian-Backed PARC Auto Continues Expansion Within the Meineke Franchise System

Kian continued to drive growth across the PARC Auto platform in 2025, acquiring five existing stores and opening three new locations.

FIRM HIGHLIGHTS

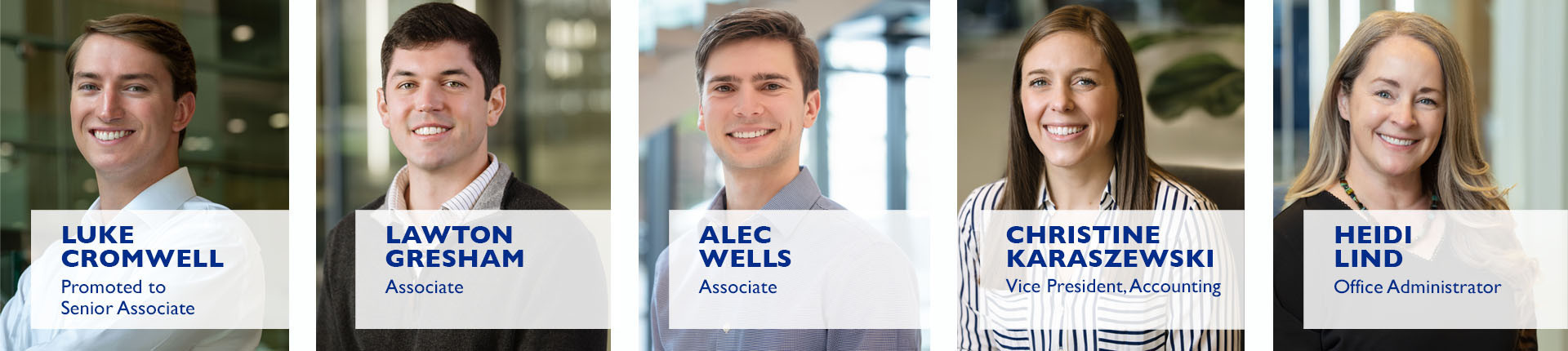

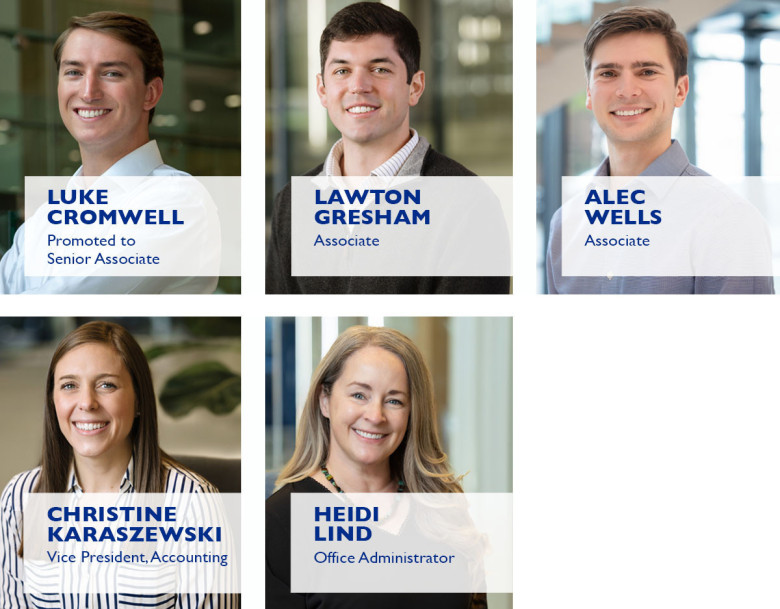

As our firm continues to evolve, we are proud to have welcomed four new professionals and celebrated one promotion at Kian in 2025. Our team members’ experience and energy strengthen our commitment to the portfolio companies we support and the managers we work with.

INVESTMENT CRITERIA

Our team has closed on over 70 platform and add-on deals since our founding. We deploy flexible and creative capital that aligns with our philosophy of creating relationships where everyone wins. With a focus on lower middle-market opportunities, we think in terms of what is right for each situation and can offer equity and mezzanine debt in structures that offer innovative solutions to each company with which we partner.

Learn More About Kian's Investment Profile

or contact David Duke, Partner, Business Development, at

dduke@kiancapital.com